Video Transcript:

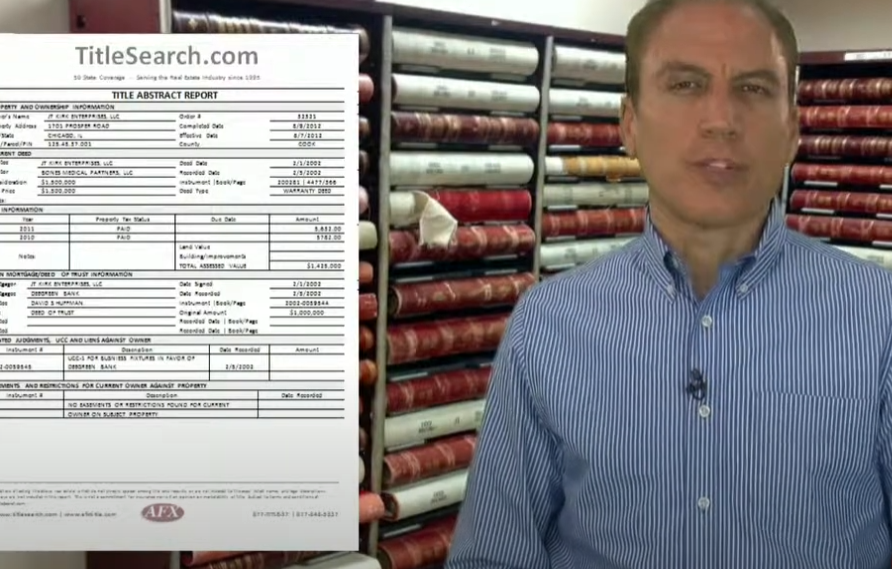

Question today from the phones came from Linda. Linda had a question about mortgage security and securitization of mortgage instruments. This is Dave at TitleSearch.com. A standard title abstract report, like the one that you see on the screen, it's going to show things like liens, ownership, judgment. It'll also give you a lot of information about mortgages on a property. One of the things that mortgages are notorious for is having been transferred from one lender to another through a process called securitization. Securitization is when a pool of mortgages is grouped together. It basically becomes an investment, and other banks or investors will buy shares in that securitization pool. When that happens, the pool can be serviced by different lenders. So one month, the borrower will be sending payments to a certain bank. And then a few months later, they go to another bank, and the banks will swap that mortgage collateral back and forth between each other. In some cases that transfer of mortgage becomes a reason where the mortgage might become invalid. A mortgage securitization audit will determine who the current holder or the mortgage is and maybe some of the information about how it was transferred. If you have questions about information on mortgage securitization, you can reach us at our website at title search dot com.