Video Transcript:

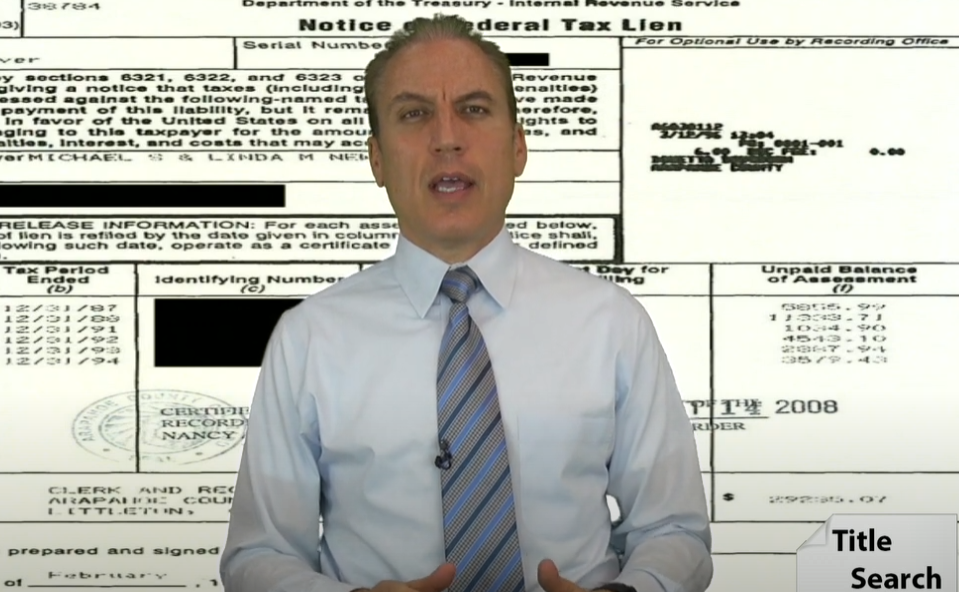

What happens if you have a federal tax lien and what should you do about it? This is Dave at TitleSearch.com. One thing about an IRS tax lien or a federal tax lien is it's actually a judgment against a person. It just automatically applies as a lien to any assets that person has in the county where it's recorded in most cases. If you have property that you own in a county and there's an IRS tax lien in your name, that judgment will more than likely attach to any property you own or property that you own in the future or you've owned in the past since that lien was recorded. It's very important to try to get this lien released as soon as possible. In some cases, an excessive lien can trigger things with your mortgage. It may trigger things with your homeowners association. It's going to put a cloud on your title, but it'd be very difficult to sell the property or even refinance it with that cloud. If there's any way to have the lien released or removed, even if it's a matter of negotiating with the Treasury Department to have that type of record not appear in your land records. If you do have an IRS tax lien or you're not sure if you do, double-check your title records. One thing about an IRS tax lien, if a certified title abstract is not prepared correctly, sometimes these things won't show up. An IRS tax lien, like the one behind me, you will not find anywhere on that form where it attaches to a particular property. And very commonly if an individual or an untrained title searcher is looking at title records, they may not think to look for this type of lien; or even if they do see it, realize that it's a lien against a property. They might just think it's a lien against a person because there's no mention of a property on it like there would be on a mortgage or a mechanics lien. An IRS tax lien is important to discover because if it's not found originally, if you go to closing, I can guarantee you that the escrow company that's doing the closing, they're going to find it, and that will maybe blow your deal if the buyer doesn't want to wait around. So if you have an IRS tax lien or you think you might owe money to the federal government, double-check your title before you want to do anything such as finance, refinance, or sell the property to somebody else. You have questions about running a search on your property? You can reach us at our website at title search dot com.