Video Transcript:

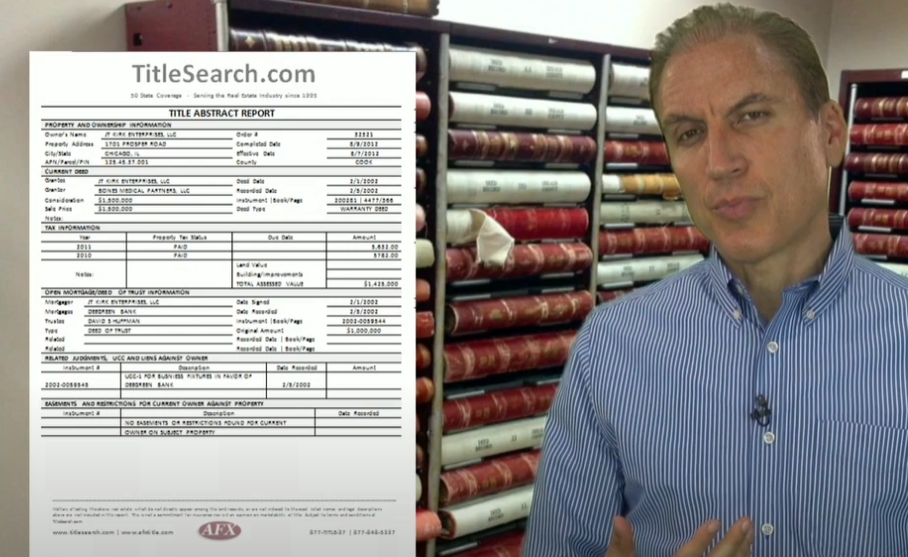

What's the difference between a mortgage balance and a mortgage amount? This is Dave at TitleSearch.com. The mortgage amount is the original value assigned to that mortgage from the lender. For example, if a house is purchased for 600,000 dollars and the people that purchase the house take out a mortgage for 450,000 dollars, 650,000 dollars will be the amount that's placed on title. Of course, the very next month, that amount is going to drop very slightly by the amount of the payments, and years go by and the mortgage gradually goes down. However, in most cases, the amount recorded on title will remain exactly the same. The original 450,000 dollars amount will remain on title. There's a few reasons for this. First of all, the lender would have to record a new filing every time that mortgage amount changed. Every filing might cost 30 or 50 or 70 dollars to record. So the expense would add up even if they changed it once a month. The second is the lender wants to retain their priority of lien against that property for the full amount of the mortgage. Let's say, for example, the mortgage is paid down from 450,000 dollars, let's say down to 380,000 dollars. But then the borrower defaults and stops paying payments and interest accrues and penalties accrue and there's legal fees. The lender wants to make sure that they still have a full amount to be able to claim against that property. If they reduce that amount every month, they are going to be very difficult to go back up to that 450,000 dollars amount. So the mortgage balance is basically like a bank account, right? -how much you have owed at that bank. The mortgage amount on title is what is the encumbrance or collateral value claimed against that piece of real estate. If you do need questions answered about real estate, mortgage balances, mortgage amount, you can reach us at our website at title search dot com.